You’ve heard of a pick-and-shovel play before.

The phrase goes back to the days of the California gold rush, when many of the profits being made weren’t from those actively looking for gold. Instead, vast fortunes were built selling picks and shovels to miners looking to strike it rich.

I also think it’s safe to say that most of the members of our investment community have taken advantage of these kinds of plays in the past.

And now it’s time to revisit this little talked-about class of oil stocks.

If you remember, I mentioned last week that Halliburton was one of the whales in the sector that commands a market cap of around $42 billion and is arguably one of the most well-known service companies on the planet.

But let’s take a step back from that and look at what a true pick-and-shovel stock is during an oil boom.

Yesterday, the EIA released its latest Drilling Productivity Report.

Inside, it projected that oil production from seven prominent tight oil regions in the U.S. will average 7.3 million barrels per day.

Let that sink in for a minute.

Right now, total U.S. crude output is around 10.9 million barrels per day.

Assuming those estimates turn out to be accurate, that means fully two-thirds of our oil production comes from tight oil plays!

Of course, you know just as well as I do that our success in these tight oil formations is due to the shale pioneers like George Mitchell. He was the one who combined horizontal drilling with hydraulic fracturing techniques and cracked the shale code that led to a generation oil boom.

But we’re not looking to play the drillers, remember?

We want to find those hidden gems in the oil sector that are milking those E&P companies for all their worth during a period of high oil prices.

And our interest today is in the latter half of that shale formula I just told you about.

It goes by many names…

Hydraulic fracturing, fracture stimulation, frac’ing, fracking — call it whatever you want.

Let me be blunt: There IS NO tight oil production without it!

The process alone involves blasting the tight formations underground with sand and fluid in order to create fissures in the rock so that the oil and natural gas can flow more freely.

There’s simply no way around it, dear reader.

And we’re talking about a lot of sand…

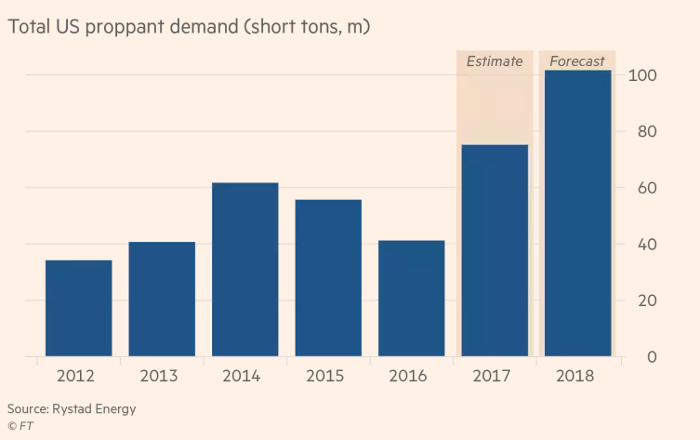

This year alone, demand for frac sand is projected to top 100 million tons.

It’s perhaps the most critical ingredient for U.S. oil drillers right now.

And they’re going to need to buy it from someone.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

Picks-and-Shovels Profits

Everyone makes money in an oil boom.

Some simply make more than others.

So when 66% of our domestic oil production is entirely dependent on U.S. oil companies having a strong supply of quality frac sand, you can understand why this might be worth a little of your time to check out.

Your due diligence on players like Hi-Crush Partners (NYSE: HCLP) may pay off in spades as oil prices make another run to $80 per barrel.

The company controls mines in both Wisconsin and West Texas. Its Kermit facility in Texas has an annual production capacity of 3 million tons of sand.

Naturally, being so close to the Permian activity means Hi-Crush doesn’t have to waste any money loading its sand onto a costly railcar; the sand can just be loaded up directly onto the truck.

In fact, 80% of the drilling activity in the Permian Basin is within 50 miles of Hi-Crush’s facility.

So exactly what kind of growth are we talking about here?

For one thing, the company’s earnings are expected to surge more than 200% year-over-year in 2018, and the stock is still trading at around seven times its trailing earnings.

Again, it’s not hard to see this opportunity for what it is right now.

Frac sand remains one of the most important ingredients to the shale boom.

And it could prove to be a very strong performer for oil investors during this bull market.

Until next time,

Keith Kohl

A true insider in the technology and energy markets, Keith’s research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing’s Energy Investor and Technology and Opportunity.

For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology.

Keith’s keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith’s Topline Trader advisory newsletter.